anchor

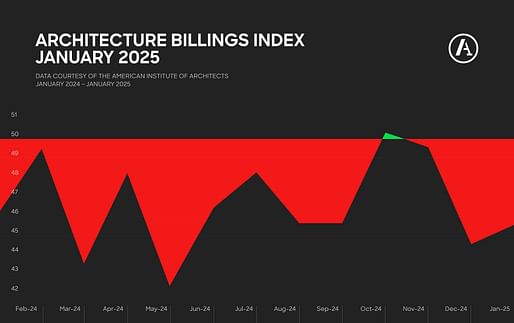

Graph by Archinect using data provided by Dodge Construction Network

Dodge Construction Network’s Dodge Momentum Index (DMI) grew 0.7% in February to 225.6 from the revised January reading of 223.9. Over the month, commercial planning increased by 3.3%, while institutional planning dropped 4.6%.

“Planning momentum moderated in February, after a few months of stronger growth,” said associate director of forecasting at Dodge Construction Network, Sarah Martin. “Data centers continue to prop up growth in the overall index. Without them, the DMI would have decreased 2% this month. Increased uncertainty around material prices and fiscal policies may begin to weigh on planning decisions, but for the time being, planning activity is largely continuing to move forward.”

In the commercial sector, data centers, traditional office buildings, and retail planning led the gains in February. On the other hand, weaker education planning brought down the institutional sector. Last month, the DMI was up 27% compared to levels from a year ago. The commercial segment was up 43% from February 2024, and the institutional segment was up 2% over the same period. Data centers have had a major impact on the DMI. As noted by Dodge Construction Network, if all data center projects between 2023 and 2025 were removed, commercial planning would instead be up 12% from year-ago levels, and the entire DMI would only be up 8%.

A total of 26 projects valued at $100 million or more entered planning throughout February. Commercial projects were led by the $500 million Tract Data Center Park in Chester, Virginia, and the largest institutional project was the $329 million Burlington High School in Burlington, Massachusetts.